TCJA and Estate Planning

Tax Cuts and Jobs Act: Key provisions affecting estate planning

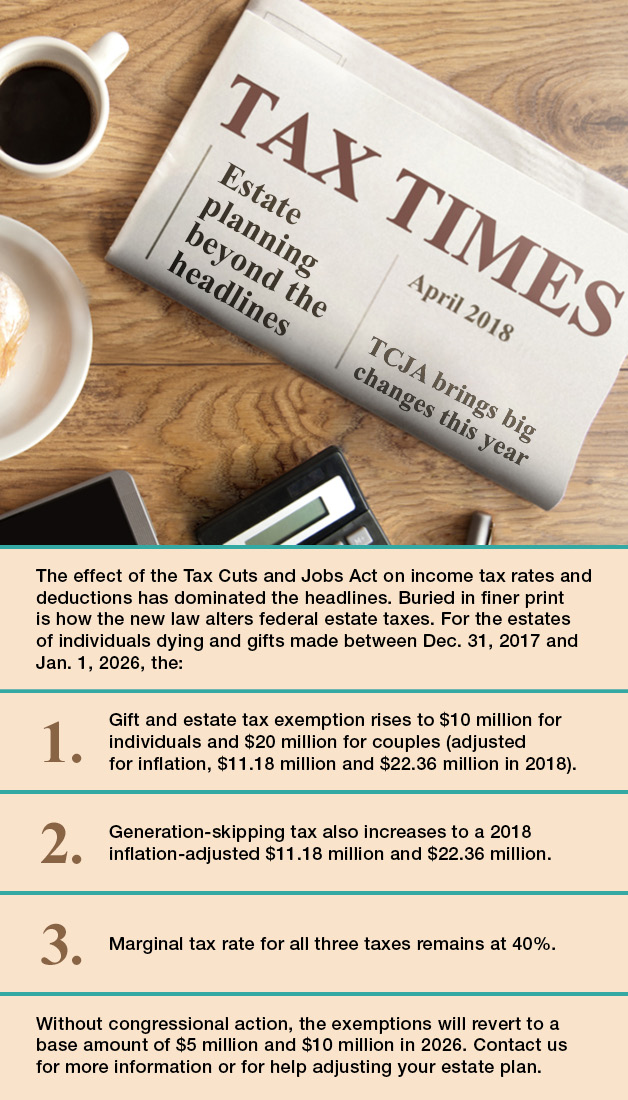

The Tax Cuts and Jobs Act of 2017 (TCJA) is a sweeping revision of the tax code that alters federal law affecting individuals, businesses and estates. Focusing specifically on estate tax law, the TCJA doesn’t repeal the federal gift and estate tax. It does, however, temporarily double the combined gift and estate tax exemption and the generation-skipping transfer (GST) tax exemption.

Beginning after December 31, 2017, and before January 1, 2026, the combined gift and estate tax exemption and the generation-skipping transfer (GST) tax exemption amounts double from an inflation-adjusted $5 million to $10 million. For 2018, the exemption amounts are expected to be $11.2 million ($22.4 million for married couples). Absent further congressional action, the exemptions will revert to their 2017 levels (adjusted for inflation) beginning January 1, 2026. The marginal tax rate for all three taxes remains at 40%.

Estate planning remains a necessity

Just because fewer families will have to worry about estate tax liability doesn’t mean the end of estate planning as we know it. Nontax issues that your plan should still take into account include asset protection, guardianship of minor children, family business succession and planning for loved ones with special needs, to name just a few.

In addition, it’s not clear how states will respond to the federal tax law changes. If you live in a state that imposes significant state estate taxes, many traditional estate-tax-reduction strategies will continue to be relevant.

Future estate tax law remains uncertain

It’s also important to keep in mind that the exemptions are scheduled to revert to their previous levels in 2026 — and there’s no guarantee that lawmakers in the future won’t reduce the exemption amounts even further. Contact us with questions on how the TCJA might affect your estate plan. We’ll be pleased to review your plan and recommend any necessary revisions in light of the TCJA.

ESTATE PLANNING & Portability Elections

IRS Simplifies Procedure for Obtaining Extension to Make Portability Election

Last month, the IRS issued a Revenue Procedure that allows certain estates to make a late portability election without first filing a ruling request. Portability is a tax law provision that permits a surviving spouse to take advantage of the deceased spouse’s unused combined gift and estate tax exemption (currently $5.49 million).

But portability isn’t automatic: It’s available only if the deceased spouse’s estate makes a portability election on a timely filed estate tax return. This return is due nine months after death, with a six-month extension option, regardless of whether any tax is owed.

What’s new?

Previously, if a deceased spouse’s estate failed to make a timely portability election, the surviving spouse’s only recourse was to request a private letter ruling from the IRS — a costly and time-consuming process. Rev. Proc. 2017-34 grants an automatic extension for taxpayers not otherwise required to file an estate tax return, provided they file a return making the election on or before the later of:

- The second anniversary of the deceased’s death, or

- January 2, 2018.

If these requirements are met, the estate may make the election by filing an estate tax return with the following language at the top: “FILED PURSUANT TO REV. PROC. 2017-34 TO ELECT PORTABILITY UNDER SECTION 2010(c)(5)(A).”

Is portability right for you?

The portability provision can provide a safety net for couples with joint assets exceeding the exemption amount of the estate of the first spouse to die. We can answer any questions regarding making the portability election.