Repairs & Deductions

Make sure repairs to tangible property were actually repairs before you deduct the cost

Repairs to tangible property, such as buildings, machinery, equipment or vehicles, can provide businesses a valuable current tax deduction — as long as the so-called repairs weren’t actually “improvements.” The costs of incidental repairs and maintenance can be immediately expensed and deducted on the current year’s income tax return. But costs incurred to improve tangible property must be depreciated over a period of years.

So the size of your 2017 deduction depends on whether the expense was a repair or an improvement.

Betterment, restoration or adaptation

In general, a cost that results in an improvement to a building structure or any of its building systems (for example, the plumbing or electrical system) or to other tangible property must be depreciated. An improvement occurs if there was a betterment, restoration or adaptation of the unit of property.

Under the “betterment test,” you generally must depreciate amounts paid for work that is reasonably expected to materially increase the productivity, efficiency, strength, quality or output of a unit of property or that is a material addition to a unit of property.

Under the “restoration test,” you generally must depreciate amounts paid to replace a part (or combination of parts) that is a major component or a significant portion of the physical structure of a unit of property.

Under the “adaptation test,” you generally must depreciate amounts paid to adapt a unit of property to a new or different use — one that isn’t consistent with your ordinary use of the unit of property at the time you originally placed it in service.

Seeking safety

Distinguishing between repairs and improvements can be difficult, but a couple of IRS safe harbors can help:

1. Routine maintenance safe harbor. Recurring activities dedicated to keeping property in efficient operating condition can be expensed. These are activities that your business reasonably expects to perform more than once during the property’s “class life,” as defined by the IRS.

Amounts incurred for activities outside the safe harbor don’t necessarily have to be depreciated, though. These amounts are subject to analysis under the general rules for improvements.

2. Small business safe harbor. For buildings that initially cost $1 million or less, qualified small businesses may elect to deduct the lesser of $10,000 or 2% of the unadjusted basis of the property for repairs, maintenance, improvements and similar activities each year. A qualified small business is generally one with gross receipts of $10 million or less.

There is also a de minimis safe harbor as well as an exemption for materials and supplies up to a certain threshold. To learn more about these safe harbors and exemptions and other ways to maximize your tangible property deductions, contact us.

IMPORTANT TAX DEADLINE

Don’t forget: 2017 tax filing deadline for pass-through entities is March 15

When it comes to income tax returns, April 15 (actually April 17 this year, because of a weekend and a Washington, D.C., holiday) isn’t the only deadline taxpayers need to think about. The federal income tax filing deadline for calendar-year partnerships, S corporations and limited liability companies (LLCs) treated as partnerships or S corporations for tax purposes is March 15. While this has been the S corporation deadline for a long time, it’s only the second year the partnership deadline has been in March rather than in April.

Why the deadline change?

One of the primary reasons for moving up the partnership filing deadline was to make it easier for owners to file their personal returns by the April filing deadline. After all, partnership (and S corporation) income passes through to the owners. The earlier date allows owners to use the information contained in the pass-through entity forms to file their personal returns.

What about fiscal-year entities?

For partnerships with fiscal year ends, tax returns are now due the 15th day of the third month after the close of the tax year. The same deadline applies to fiscal-year S corporations. Under prior law, returns for fiscal-year partnerships were due the 15th day of the fourth month after the close of the fiscal tax year.

What about extensions?

If you haven’t filed your calendar-year partnership or S corporation return yet, you may be thinking about an extension. Under the current law, the maximum extension for calendar-year partnerships is six months (until September 17, 2018, for 2017 returns). This is up from five months under prior law. So the extension deadline is the same — only the length of the extension has changed. The extension deadline for calendar-year S corporations also is September 17, 2018, for 2017 returns.

Whether you’ll be filing a partnership or an S corporation return, you must file for the extension by March 15 if it’s a calendar-year entity.

When does an extension make sense?

Filing for an extension can be tax-smart if you’re missing critical documents or you face unexpected life events that prevent you from devoting sufficient time to your return right now.

But keep in mind that, to avoid potential interest and penalties, you still must (with a few exceptions) pay any tax due by the unextended deadline. There may not be any tax liability from the partnership or S corporation return. If, however, filing for an extension for the entity return causes you to also have to file an extension for your personal return, you need to keep this in mind related to the individual tax return April 17 deadline.

Have more questions about the filing deadlines that apply to you or avoiding interest and penalties? Contact us.

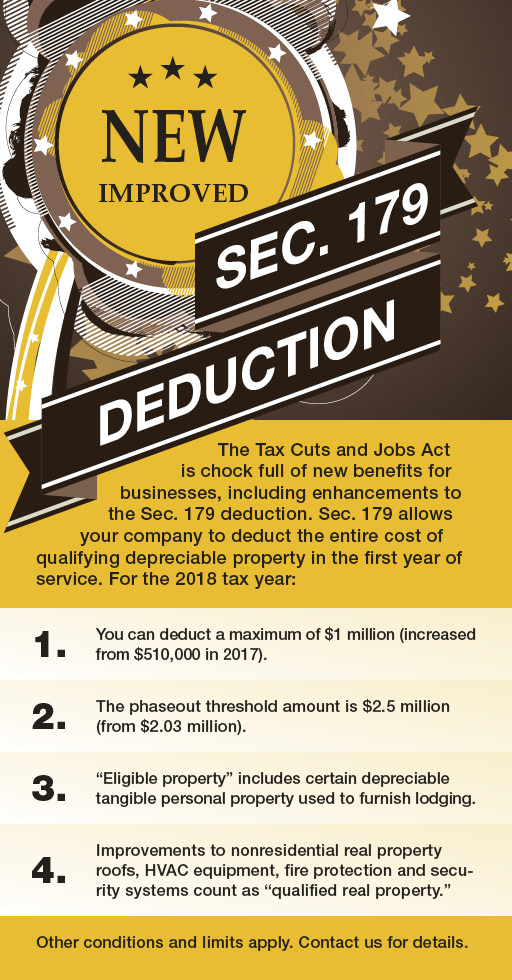

Sec. 179 Enhancements

Get the Most Out of Your Charitable Deductions

Follow IRS rules to ensure you receive your charitable tax deductions

If reducing your taxable estate is an important estate planning goal, making lifetime charitable donations can help achieve that goal and benefit your favorite organizations. In addition, by making donations during your lifetime, rather than at death, you can claim income tax deductions. But some of your charitable deductions could be denied if you don’t follow IRS rules.

3 things to be aware of

First, the recipient charity must be a qualified charitable organization: It must have a tax-exempt status. The IRS has developed a tool on its website — the Exempt Organizations Select Check — that allows users to search for a specific tax-exempt organization, check its federal tax status and learn about tax forms the charity may file that are up for public review.

Second, the timing of pledging vs. payment of your charitable contributions can affect your deduction. Why? For most taxpayers, contributions are deductible only in the tax year they’re made. So if you pledged $5,000 in October of 2017, but paid only $1,500 of your pledge to the charity by December 31, 2017, you’re allowed to deduct only the $1,500 amount on your 2017 tax return.

Third, if you donate property and receive something in return, it’s important to know the fair market value of each item. For example, if you donate a flat screen TV to your child’s school and receive two tickets to a sporting event in return for your donation, you must first determine the value of your donation. Then you may deduct only the amount exceeding the fair market value of the two tickets.

Substantiate your donations

Be aware that substantiation rules also apply when giving cash or property to charity, and they vary based on the type and amount of the donation. For example, cash gifts of $250 or more require a “contemporaneous” written acknowledgment from the charity that includes information such as the gift’s amount and date and the estimated value of any goods or services received. For smaller gifts, a canceled check or credit card receipt may be sufficient.

If you’ve made substantial charitable donations, their deductibility depends on compliance with IRS rules, which go far beyond what we’ve discussed here. When in doubt, contact us to be sure you’ve dotted all the i’s and crossed all the t’s.

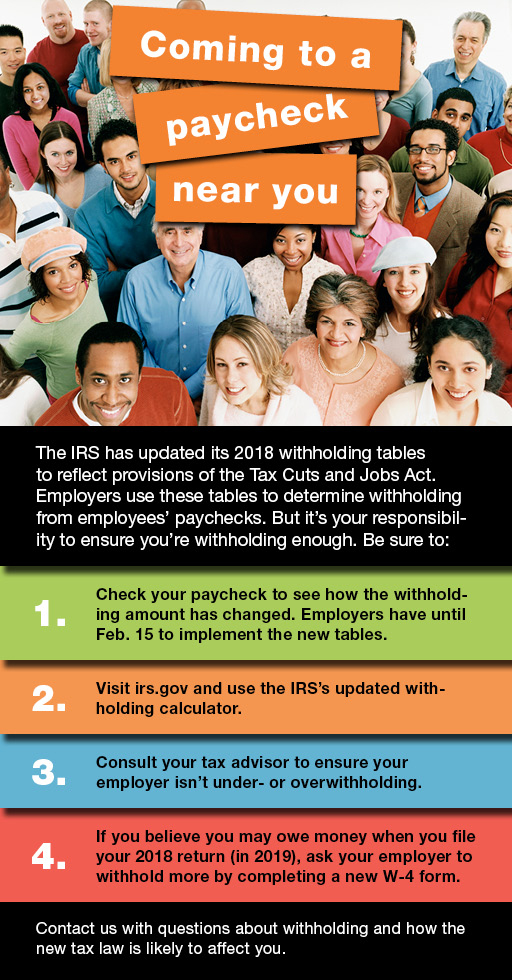

Updated 2018 Withholding Tables

Changes to Meal, Entertainment and Transportation Deductions

Meals, entertainment and transportation may cost businesses more under the TCJA

Along with tax rate reductions and a new deduction for pass-through qualified business income, the new tax law brings the reduction or elimination of tax deductions for certain business expenses. Two expense areas where the Tax Cuts and Jobs Act (TCJA) changes the rules — and not to businesses’ benefit — are meals/entertainment and transportation. In effect, the reduced tax benefits will mean these expenses are more costly to a business’s bottom line.

Meals and entertainment

Prior to the TCJA, taxpayers generally could deduct 50% of expenses for business-related meals and entertainment. Meals provided to an employee for the convenience of the employer on the employer’s business premises were 100% deductible by the employer and tax-free to the recipient employee.

Under the new law, for amounts paid or incurred after December 31, 2017, deductions for business-related entertainment expenses are disallowed.

Meal expenses incurred while traveling on business are still 50% deductible, but the 50% limit now also applies to meals provided via an on-premises cafeteria or otherwise on the employer’s premises for the convenience of the employer. After 2025, the cost of meals provided through an on-premises cafeteria or otherwise on the employer’s premises will no longer be deductible.

Transportation

The TCJA disallows employer deductions for the cost of providing commuting transportation to an employee (such as hiring a car service), unless the transportation is necessary for the employee’s safety.

The new law also eliminates employer deductions for the cost of providing qualified employee transportation fringe benefits. Examples include parking allowances, mass transit passes and van pooling. These benefits are, however, still tax-free to recipient employees.

Transportation expenses for employee work-related travel away from home are still deductible (and tax-free to the employee), as long as they otherwise qualify for such tax treatment. (Note that, for 2018 through 2025, employees can’t deduct unreimbursed employee business expenses, such as travel expenses, as a miscellaneous itemized deduction.)

Assessing the impact

The TCJA’s changes to deductions for meals, entertainment and transportation expenses may affect your business’s budget. Depending on how much you typically spend on such expenses, you may want to consider changing some of your policies and/or benefits offerings in these areas. We’d be pleased to help you assess the impact on your business.

Mileage Rates

529 Plan & Your Estate Plan

Tax Cuts and Jobs Act expands appeal of 529 plans in estate planning

It’s common for grandparents to want to help ensure their grandchildren will get a high quality education. And, along the same lines, they also want the peace of mind that their wealth will be preserved for their children and grandchildren after they’re gone. If you’re facing these challenges, one option that can help you conquer both is a 529 plan. And it’s become even more attractive under the Tax Cuts and Jobs Act (TCJA).

529 plan in action

In a nutshell, a 529 plan is one of the most flexible tools available for funding college expenses and it can provide significant estate planning benefits. 529 plans are sponsored by states, state agencies and certain educational institutions. You can choose a prepaid tuition plan to secure current tuition rates or a tax-advantaged savings plan to fund college expenses. The savings plan version allows you to make cash contributions to a tax-advantaged investment account and to withdraw both contributions and earnings free of federal — and, in most cases, state — income taxes for “qualified education expenses.”

Qualified expenses include tuition, fees, books, supplies, equipment, and a limited amount of room and board. And beginning this year, the TCJA has expanded the definition of qualified expenses to include not just postsecondary school expenses but also primary and secondary school expenses. This change is permanent.

529 plan and your estate plan

529 plans offer several estate planning benefits. First, even though you can change beneficiaries or get your money back, 529 plan contributions are considered “completed gifts” for federal gift and generation-skipping transfer (GST) tax purposes. As such, they’re eligible for the annual exclusion, which allows you to make gifts of up to $15,000 per year ($30,000 for married couples) to any number of recipients, without triggering gift or GST taxes and without using any of your lifetime exemption amounts.

For estate tax purposes, all of your contributions, together with all future earnings, are removed from your taxable estate even though you retain control over the funds. Most estate tax saving strategies require you to relinquish control over your assets — for example, by placing them in an irrevocable trust. But a 529 plan shields assets from estate taxes even though you retain the right (subject to certain limitations) to control the timing of distributions, change beneficiaries, move assets from one plan to another or get your money back (subject to taxes and penalties).

529 plans accept only cash contributions, so you can’t use stock or other assets to fund an account. Also, their administrative fees may be higher than those of other investment vehicles. Contact us to help you plan for the distribution of your wealth using various estate planning strategies, such as a 529 plan.

Valuable Deduction

New tax law gives pass-through businesses a valuable deduction

Although the drop of the corporate tax rate from a top rate of 35% to a flat rate of 21% may be one of the most talked about provisions of the Tax Cuts and Jobs Act (TCJA), C corporations aren’t the only type of entity significantly benefiting from the new law. Owners of noncorporate “pass-through” entities may see some major — albeit temporary — relief in the form of a new deduction for a portion of qualified business income (QBI).

A 20% deduction

For tax years beginning after December 31, 2017, and before January 1, 2026, the new deduction is available to individuals, estates and trusts that own interests in pass-through business entities. Such entities include sole proprietorships, partnerships, S corporations and, typically, limited liability companies (LLCs). The deduction generally equals 20% of QBI, subject to restrictions that can apply if taxable income exceeds the applicable threshold — $157,500 or, if married filing jointly, $315,000.

QBI is generally defined as the net amount of qualified items of income, gain, deduction and loss from any qualified business of the noncorporate owner. For this purpose, qualified items are income, gain, deduction and loss that are effectively connected with the conduct of a U.S. business. QBI doesn’t include certain investment items, reasonable compensation paid to an owner for services rendered to the business or any guaranteed payments to a partner or LLC member treated as a partner for services rendered to the partnership or LLC.

The QBI deduction isn’t allowed in calculating the owner’s adjusted gross income (AGI), but it reduces taxable income. In effect, it’s treated the same as an allowable itemized deduction.

The limitations

For pass-through entities other than sole proprietorships, the QBI deduction generally can’t exceed the greater of the owner’s share of:

- 50% of the amount of W-2 wages paid to employees by the qualified business during the tax year, or

- The sum of 25% of W-2 wages plus 2.5% of the cost of qualified property.

Qualified property is the depreciable tangible property (including real estate) owned by a qualified business as of year end and used by the business at any point during the tax year for the production of qualified business income.

Another restriction is that the QBI deduction generally isn’t available for income from specified service businesses. Examples include businesses that involve investment-type services and most professional practices (other than engineering and architecture).

The W-2 wage limitation and the service business limitation don’t apply as long as your taxable income is under the applicable threshold. In that case, you should qualify for the full 20% QBI deduction.

Careful planning required

Additional rules and limits apply to the QBI deduction, and careful planning will be necessary to gain maximum benefit. Please contact us for more details.

New Tax Law

100% Bonus Depreciation

The TCJA temporarily expands bonus depreciation

The Tax Cuts and Jobs Act (TCJA) enhances some tax breaks for businesses while reducing or eliminating others. One break it enhances — temporarily — is bonus depreciation. While most TCJA provisions go into effect for the 2018 tax year, you might be able to benefit from the bonus depreciation enhancements when you file your 2017 tax return.

Pre-TCJA bonus depreciation

Under pre-TCJA law, for qualified new assets that your business placed in service in 2017, you can claim a 50% first-year bonus depreciation deduction. Used assets don’t qualify. This tax break is available for the cost of new computer systems, purchased software, vehicles, machinery, equipment, office furniture, etc.

In addition, 50% bonus depreciation can be claimed for qualified improvement property, which means any qualified improvement to the interior portion of a nonresidential building if the improvement is placed in service after the date the building is placed in service. But qualified improvement costs don’t include expenditures for the enlargement of a building, an elevator or escalator, or the internal structural framework of a building.

TCJA expansion

The TCJA significantly expands bonus depreciation: For qualified property placed in service between September 28, 2017, and December 31, 2022 (or by December 31, 2023, for certain property with longer production periods), the first-year bonus depreciation percentage increases to 100%. In addition, the 100% deduction is allowed for not just new but also used qualifying property.

The new law also allows 100% bonus depreciation for qualified film, television and live theatrical productions placed in service on or after September 28, 2017. Productions are considered placed in service at the time of the initial release, broadcast or live commercial performance.

Beginning in 2023, bonus depreciation is scheduled to be reduced 20 percentage points each year. So, for example, it would be 80% for property placed in service in 2023, 60% in 2024, etc., until it would be fully eliminated in 2027.

For certain property with longer production periods, the reductions are delayed by one year. For example, 80% bonus depreciation would apply to long-production-period property placed in service in 2024.

Bonus depreciation is only one of the business tax breaks that have changed under the TCJA. Contact us for more information on this and other changes that will impact your business.

TCJA and Estate Planning

Tax Cuts and Jobs Act: Key provisions affecting estate planning

The Tax Cuts and Jobs Act of 2017 (TCJA) is a sweeping revision of the tax code that alters federal law affecting individuals, businesses and estates. Focusing specifically on estate tax law, the TCJA doesn’t repeal the federal gift and estate tax. It does, however, temporarily double the combined gift and estate tax exemption and the generation-skipping transfer (GST) tax exemption.

Beginning after December 31, 2017, and before January 1, 2026, the combined gift and estate tax exemption and the generation-skipping transfer (GST) tax exemption amounts double from an inflation-adjusted $5 million to $10 million. For 2018, the exemption amounts are expected to be $11.2 million ($22.4 million for married couples). Absent further congressional action, the exemptions will revert to their 2017 levels (adjusted for inflation) beginning January 1, 2026. The marginal tax rate for all three taxes remains at 40%.

Estate planning remains a necessity

Just because fewer families will have to worry about estate tax liability doesn’t mean the end of estate planning as we know it. Nontax issues that your plan should still take into account include asset protection, guardianship of minor children, family business succession and planning for loved ones with special needs, to name just a few.

In addition, it’s not clear how states will respond to the federal tax law changes. If you live in a state that imposes significant state estate taxes, many traditional estate-tax-reduction strategies will continue to be relevant.

Future estate tax law remains uncertain

It’s also important to keep in mind that the exemptions are scheduled to revert to their previous levels in 2026 — and there’s no guarantee that lawmakers in the future won’t reduce the exemption amounts even further. Contact us with questions on how the TCJA might affect your estate plan. We’ll be pleased to review your plan and recommend any necessary revisions in light of the TCJA.

Tax Cuts and Jobs Act

Tax Cuts and Jobs Act: Key provisions affecting businesses

The recently passed tax reform bill, commonly referred to as the “Tax Cuts and Jobs Act” (TCJA), is the most expansive federal tax legislation since 1986. It includes a multitude of provisions that will have a major impact on businesses.

Here’s a look at some of the most significant changes. They generally apply to tax years beginning after December 31, 2017, except where noted.

- Replacement of graduated corporate tax rates ranging from 15% to 35% with a flat corporate rate of 21%

- Repeal of the 20% corporate alternative minimum tax (AMT)

- New 20% qualified business income deduction for owners of flow-through entities (such as partnerships, limited liability companies and S corporations) and sole proprietorships — through 2025

- Doubling of bonus depreciation to 100% and expansion of qualified assets to include used assets — effective for assets acquired and placed in service after September 27, 2017, and before January 1, 2023

- Doubling of the Section 179 expensing limit to $1 million and an increase of the expensing phaseout threshold to $2.5 million

- Other enhancements to depreciation-related deductions

- New disallowance of deductions for net interest expense in excess of 30% of the business’s adjusted taxable income (exceptions apply)

- New limits on net operating loss (NOL) deductions

- Elimination of the Section 199 deduction, also commonly referred to as the domestic production activities deduction or manufacturers’ deduction — effective for tax years beginning after December 31, 2017, for noncorporate taxpayers and for tax years beginning after December 31, 2018, for C corporation taxpayers

- New rule limiting like-kind exchanges to real property that is not held primarily for sale

- New tax credit for employer-paid family and medical leave — through 2019

- New limitations on excessive employee compensation

- New limitations on deductions for employee fringe benefits, such as entertainment and, in certain circumstances, meals and transportation

Keep in mind that additional rules and limits apply to what we’ve covered here, and there are other TCJA provisions that may affect your business. Contact us for more details and to discuss what your business needs to do in light of these changes.

Holiday Party Deductions for 2018?

This year’s company holiday party is probably tax deductible, but next year’s may not be

Many businesses are hosting holiday parties for employees this time of year. It’s a great way to reward your staff for their hard work and have a little fun. And you can probably deduct 100% of your 2017 party’s cost as a meal and entertainment (M&E) expense. Next year may be a different story.

The 100% deduction

For 2017, businesses generally are limited to deducting 50% of allowable meal and entertainment expenses. But certain expenses are 100% deductible, including expenses:

- For recreational or social activities for employees, such as holiday parties and summer picnics,

- For food and beverages furnished at the workplace primarily for employees, and

- That are excludable from employees’ income as de minimis fringe benefits.

There is one caveat for a 100% deduction: The entire staff must be invited. Otherwise, expenses are deductible under the regular business entertainment rules.

Additional requirements

Whether you deduct 50% or 100% of allowable expenses, there are a number of requirements, including certain records you must keep to prove your expenses.

If your company has substantial meal and entertainment expenses, you can reduce your 2017 tax bill by separately accounting for and documenting expenses that are 100% deductible. If doing so would create an administrative burden, you may be able to use statistical sampling methods to estimate the portion of meal and entertainment expenses that are fully deductible.

Possible changes for 2018

It appears the M&E deduction for employee parties — along with deductions for many other M&E expenses — will be eliminated beginning in 2018 under the reconciled version of the Tax Cuts and Jobs Act. For more information about deducting business meals and entertainment, including how to take advantage of the 100% deduction when you file your 2017 return, please contact us.

A New Vehicle for 2018?

Should you buy a business vehicle before year end?

One way to reduce your 2017 tax bill is to buy a business vehicle before year end. But don’t make a purchase without first looking at what your 2017 deduction would be and whether tax reform legislation could affect the tax benefit of a 2017 vs. 2018 purchase.

Your 2017 deduction

Business-related purchases of new or used vehicles may be eligible for Section 179 expensing, which allows you to immediately deduct, rather than depreciate over a period of years, some or all of the vehicle’s cost. But the size of your 2017 deduction will depend on several factors. One is the gross vehicle weight rating.

The normal Sec. 179 expensing limit generally applies to vehicles with a gross vehicle weight rating of more than 14,000 pounds. The limit for 2017 is $510,000, and the break begins to phase out dollar-for-dollar when total asset acquisitions for the tax year exceed $2.03 million.

But a $25,000 limit applies to SUVs rated at more than 6,000 pounds but no more than 14,000 pounds. Vehicles rated at 6,000 pounds or less are subject to the passenger automobile limits. For 2017, under current law, the depreciation limit is $3,160. And the amount that may be deducted under the combination of Modified Accelerated Cost Recovery System (MACRS) depreciation and Sec. 179 for the first year is limited under the luxury auto rules to $11,160.

In addition, if a vehicle is used for business and personal purposes, the associated expenses, including depreciation, must be allocated between deductible business use and nondeductible personal use. The depreciation limit is reduced if the business use is less than 100%. If the business use is 50% or less, you can’t use Sec. 179 expensing or the accelerated regular MACRS; you must use the straight-line method.

Factoring in tax reform

If tax reform legislation is signed into law and it will cause your marginal rate to go down in 2018, then purchasing a vehicle by December 31, 2017, could save you more tax than waiting until 2018. Why? Tax deductions are more powerful when rates are higher. But if your 2017 Sec. 179 expense deduction would be reduced or eliminated because of the asset acquisition phaseout, then you might be better off waiting until 2018 to buy.

Also be aware that tax reform legislation could affect the depreciation limits for passenger vehicles, even if purchased in 2017.

These are just a few factors to look at. Many additional rules and limits apply to these breaks. So if you’re considering a business vehicle purchase, contact us to discuss whether it would make more tax sense to buy this year or next.

Unique Tax Planning Strategies

Accrual-basis taxpayers: These year-end tips could save you tax

With the possibility that tax law changes could go into effect next year that would significantly reduce income tax rates for many businesses, 2017 may be an especially good year to accelerate deductible expenses. Why? Deductions save more tax when rates are higher.

Timing income and expenses can be a little more challenging for accrual-basis taxpayers than for cash-basis ones. But being an accrual-basis taxpayer also offers valuable year-end tax planning opportunities when it comes to deductions.

Tracking incurred expenses

The key to saving tax as an accrual-basis taxpayer is to properly record and recognize expenses that were incurred this year but won’t be paid until 2018. This will enable you to deduct those expenses on your 2017 federal tax return. Common examples of such expenses include:

- Commissions, salaries and wages,

- Payroll taxes,

- Advertising,

- Interest,

- Utilities,

- Insurance, and

- Property taxes.

You can also accelerate deductions into 2017 without actually paying for the expenses in 2017 by charging them on a credit card. (This works for cash-basis taxpayers, too.)

As noted, accelerating deductible expenses into 2017 may be especially beneficial if tax rates go down for 2018.

Prepaid expenses

Also review all prepaid expense accounts. Then write off any items that have been used up before the end of the year.

If you prepay insurance for a period of time beginning in 2017, you can expense the entire amount this year rather than spreading it between 2017 and 2018, as long as a proper method election is made. This is treated as a tax expense and thus won’t affect your internal financials.

And there’s more …

Here are a few more year-end tax tips to consider:

- Review your outstanding receivables and write off any receivables you can establish as uncollectible.

- Pay interest on all shareholder loans to or from the company.

- Update your corporate record book to record decisions and be better prepared for an audit.

To learn more about how these and other year-end tax strategies may help your business reduce its 2017 tax bill, contact us.

Estate Tax Law

Tax reform and estate planning: What’s on the table

As Congress and President Trump pursue their stated goal of passing sweeping new tax legislation before the end of the year, many taxpayers are wondering how such legislation will affect them. One area of particular interest is estate planning; specifically, the future of gift, estate and generation-skipping transfer (GST) taxes.

Potential estate tax law changes are emerging

Under current law, the combined federal gift and estate tax exemption, and the GST tax exemption, is $5.49 million. The top tax rate for all three taxes is 40%. The annual gift tax exclusion is $14,000. That means you can reduce your taxable estate by making tax-free gifts of up to $14,000 per year to an unlimited number of people without tapping your lifetime gift and estate tax exemption.

The U.S. House version of the Tax Cuts and Jobs Act that passed on November 16 increases the exemptions to $10 million (adjusted annually for inflation) and repeals the estate tax after 2024. It also terminates the GST tax at that time. Under the bill, the annual gift tax exclusion stays in place (at $15,000 for 2018 due to inflation indexing), and after 2024 the gift tax is retained but the rate falls to 35%.

The Senate’s version of the bill (as initially approved by the Senate Finance Committee) would also double the exemption for gift and estate taxes. It doesn’t address the GST tax, though, and makes no mention of repealing the estate tax. The full Senate will be addressing the bill after the Thanksgiving recess.

All eyes are on Congress

With the disparity between the House and Senate approaches to the estate tax, some prognosticators doubt a final reconciled bill will include an estate tax repeal. And it’s worth noting that the tax has been repealed in the past, only to be resurrected when party control subsequently changed hands in Washington.

At this point, the question of whether any tax bill will pass is still up in the air. But we can help you chart the best course to accomplish your estate planning goals under current and future tax provisions.

Tax-Smart Exclusion Gifts

Make the holidays bright for you and your loved ones with annual exclusion gifts

As the holiday season quickly approaches, gift giving will be top of mind. While gifts of electronics, toys and clothes are nice, making tax-free gifts of cash using your annual exclusion is beneficial for both you and your family.

Even in a potentially changing estate tax environment, making annual exclusion gifts before year end can still benefit your estate plan.

Understanding the annual exclusion

The 2017 gift tax annual exclusion allows you to give up to $14,000 per recipient tax-free without using up any of your $5.49 million lifetime gift tax exemption. If you and your spouse “split” the gift, you can give $28,000 per recipient. The gifts are also generally excluded from the generation-skipping transfer tax, which typically applies to transfers to grandchildren and others more than one generation below you.

The gifted assets are removed from your taxable estate, which can be especially advantageous if you expect them to appreciate. That’s because the future appreciation can also avoid gift and estate taxes.

Making gifts in 2017 and beyond

Be aware that time is running out to make annual exclusion gifts this year: December 31 is the deadline. It’s also important to know that next year the exclusion amount increases for the first time since 2013, to $15,000 ($30,000 for split gifts). And the inflation-adjusted gift and estate tax exemption is currently scheduled to increase to $5.6 million in 2018.

It’s also important to keep an eye on Congress. With both the U.S. House of Representatives and U.S. Senate now having released their tax reform bills, more details regarding the potential future of the estate tax have emerged. But what, if any, estate tax law changes are ultimately passed remains to be seen. Even if the estate tax is repealed, it likely won’t be permanent. And current proposals retain the gift tax. So making 2017 annual exclusion gifts can still be a tax-smart move.

In the meantime, we can help you determine how to make the most of your 2017 gift tax annual exclusion and keep you abreast of the latest regarding new estate tax laws.